Tax reliefs for investors

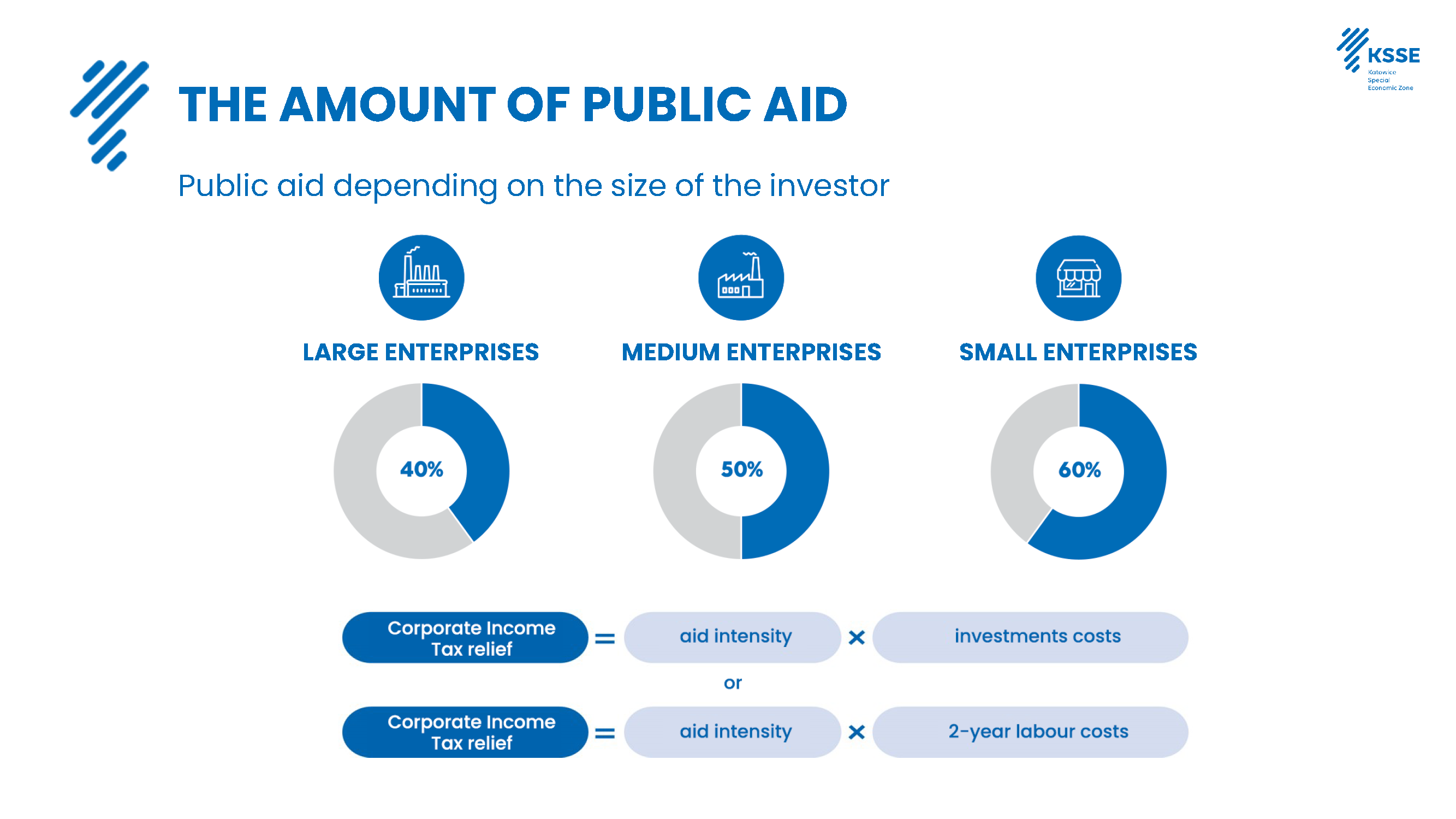

Tax reliefs granted to investment projects implemented in the area of the Katowicka Special Economic Zone are in line with the rules applicable to similar organisations functioning in the Member States of the European Union. Income tax reliefs for companies investing in the Katowicka Special Economic Zone can be calculated according to one of the following methods:

Which costs can be classified as eligible?

Eligible expenditure includes investment costs, less input VAT and excise tax, if VAT and excise tax are deductible under separate legislation, incurred within the zone during the validity of the decision on support. For example:

1. costs associated with the purchase of land or the right of perpetual usufruct of land;

2. the purchase price or the costs of manufacture of fixed assets, complete and ready for use as at the date of their acceptance for use, provided that such fixed assets are classified, in accordance with separate regulations, as the taxpayer’s assets and entered in the register of fixed assets and intangible assets;

3. the costs of the extension or refurbishment of existing fixed assets;

4. the purchase price of intangible assets relating to the transfer of technology through the acquisition of patent rights, licences, know-how and unpatented technical knowledge, subject to items 2 and 3;

5. costs connected with the lease or rental of land, buildings and structures, provided that the lease or rental period is at least 5 years, and in the case of micro-entrepreneurs, small entrepreneurs and medium-sized entrepreneurs at least 3 years, counting from the date of completion of a new investment;

6. the purchase price of assets other than land, buildings and structures covered by a lease or rental agreement, where such an agreement takes the form of a finance lease and includes an obligation to purchase the assets at the expiry of the lease or rental agreement.

For more information >> see here